In our previous blog on total revenue of Indian cities, we explored how total revenues vary dramatically across Indian cities, with resources concentrated in major metropolitan areas. But these total revenue figures reveal only a part of the story.

Understanding where that revenue comes from is equally important. The composition of a city’s revenue, how much it raises on its own versus how much it receives from higher tiers of government, speaks directly to its fiscal autonomy, financial resilience, and capacity for self-determined growth. Examining revenue composition thus moves the conversation beyond how much cities earn to how they earn it.

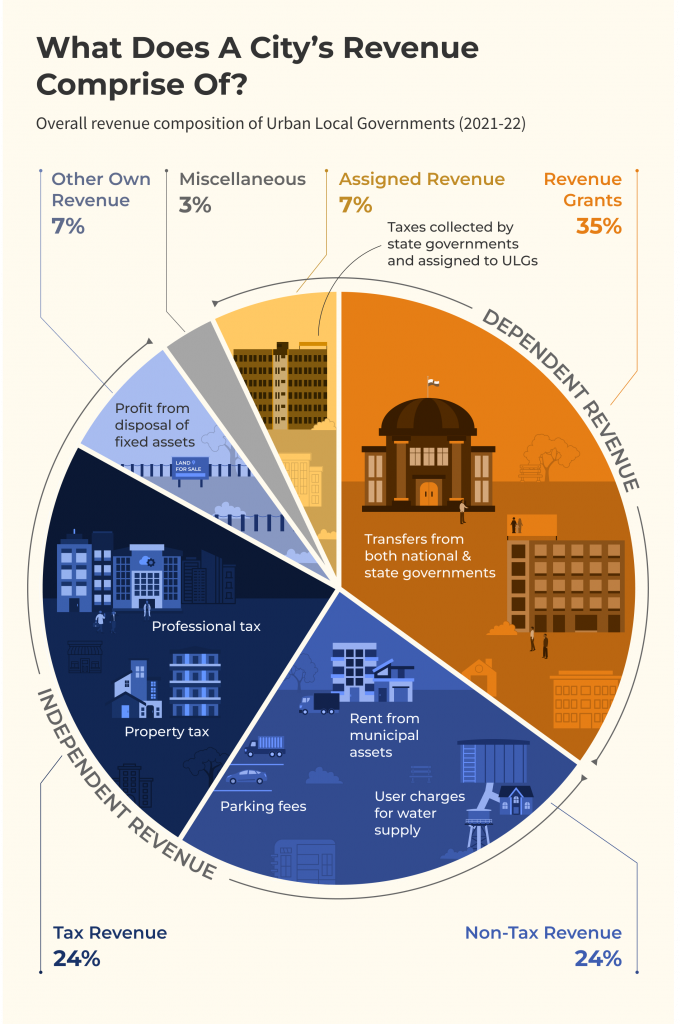

As shown in the figure above, at the national level, the composition of municipal revenues exhibits a substantial share of grant revenue across ULGs. However, when we look at the graph below, we can see that this share is comparatively lower for million-plus cities. CityFinance data shows that larger ULGs, particularly million-plus cities, demonstrate a stronger own-source revenue base, supported by both tax and non-tax revenues, relative to smaller cities.

Although million-plus cities receive significant volumes of grants, these constitute a smaller proportion of their total revenue when compared to smaller ULGs. This reflects the larger revenue base of metropolitan cities, where tax and non-tax revenues contribute a greater share to overall municipal finances.

Notably, 4M+ cities show a relatively higher share of non-tax revenue within their revenue. This indicates a more diversified revenue composition with contributions from user charges, fees, rentals, and other service-related income streams alongside tax revenue. In contrast, smaller ULGs exhibit a relatively higher dependence on revenue grants within their overall revenue structure.

Overall, the data highlights variation in revenue composition across city size categories, reflecting differences in revenue structure and scale across urban India.

When compared with the national profile, state-wise regional variation becomes much more evident for FY 2021-22.

Northern states such as Uttar Pradesh (80% grants), Uttarakhand (84%), and Bihar (67%) show grant shares well above the national aggregate composition, with relatively lower tax and non-tax contributions. In contrast, southern states display a different composition: Telangana records 48% tax revenue and Andhra Pradesh 42% tax revenue, while Tamil Nadu shows a more balanced mix with 29% tax revenue and 34% grants. Gujrat and Maharashtra also exhibit less dependence on grants when compared to national aggregate composition.

Overall, the comparison reflects regional differences in revenue structure relative to the national composition, highlighting variation across India’s urban fiscal landscape.

The Way Forward

The analysis underscores that revenue profile of cities in India cannot be understood through aggregate revenue figures alone. A deeper look at revenue composition reveals important distinctions. While the proportion of intergovernmental grants in revenue composition of smaller cities remains higher, larger cities continue to receive higher per capita grants. The findings suggest that million-plus cities show higher collection of own-source revenue. Assigned revenue on the other hand decreased consistently which is a trend that warrants closer examination. The variations across states further reinforce that fiscal outcomes are influenced by governance structures, devolution frameworks and accounting practices.

Moving beyond aggregate figures to examine how city revenues are composed will offer a far more comprehensive understanding of where Indian cities stand fiscally and what it will take to strengthen their financial foundations.

In our next blog, we turn to Own Source Revenue performance across city categories and states and what it reveals about the fiscal health of India’s urban local governments. Stay tuned.

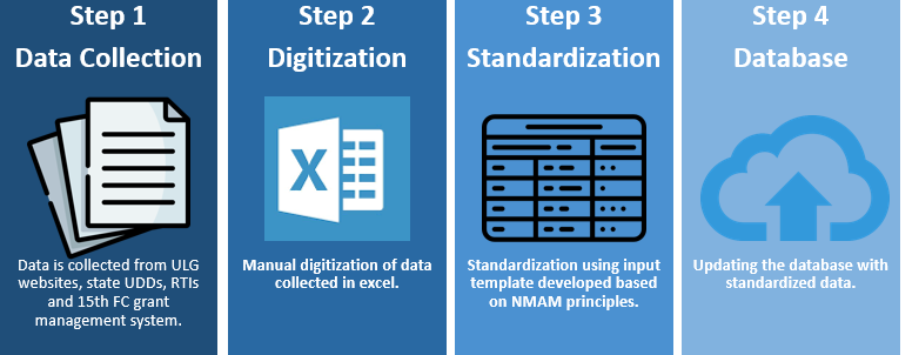

Note: All data is sourced from the Annual Financial Statements submitted by the ULGs on the CityFinance platform. To ensure comprehensive representation and account for variations in data coverage and quality across cities, the figures presented are based on extrapolated financial data covering all 4,824 cities. Among these, 2,541 cities (approximately 60%) possess 3 years of contiguous data (2019–20 to 2021–22) in Cityfinance platform. Data from these cities have been systematically extrapolated using the ’per capita scaling methodology’ to reflect the financial performance of the complete set of 4,824 cities. Learn more about the extrapolation methodology here.